tesla tax credit 2021 north carolina

Are Dental Implants Tax Deductible In Ireland. Tesla vehicles no longer qualify for the base 7500 and unfortunately will not qualify for the additional 5000 if the bill remains as is.

Used Tesla For Sale In Lexington Nc Jerry Hunt Supercenter

Reference North Carolina General Statutes 105-16413.

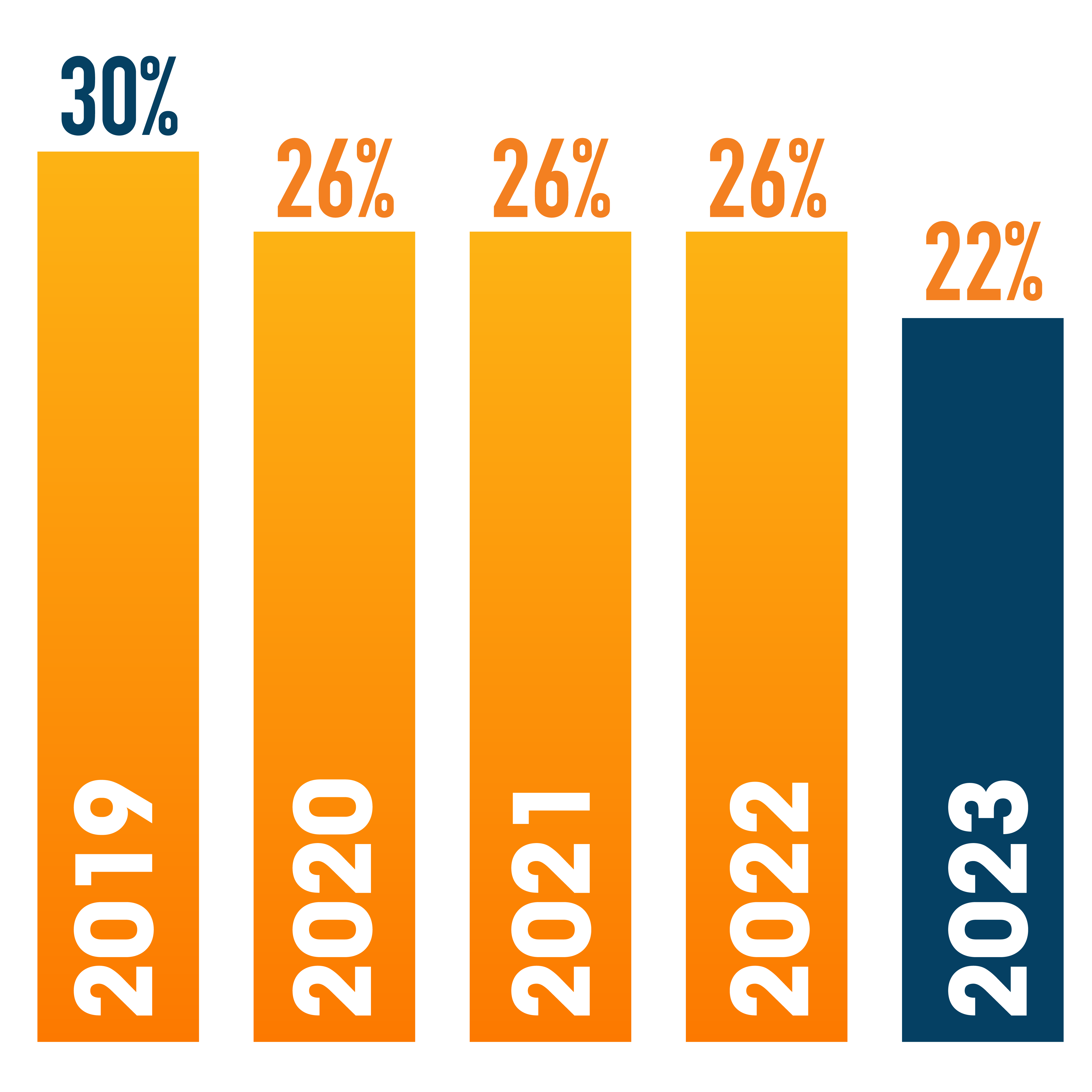

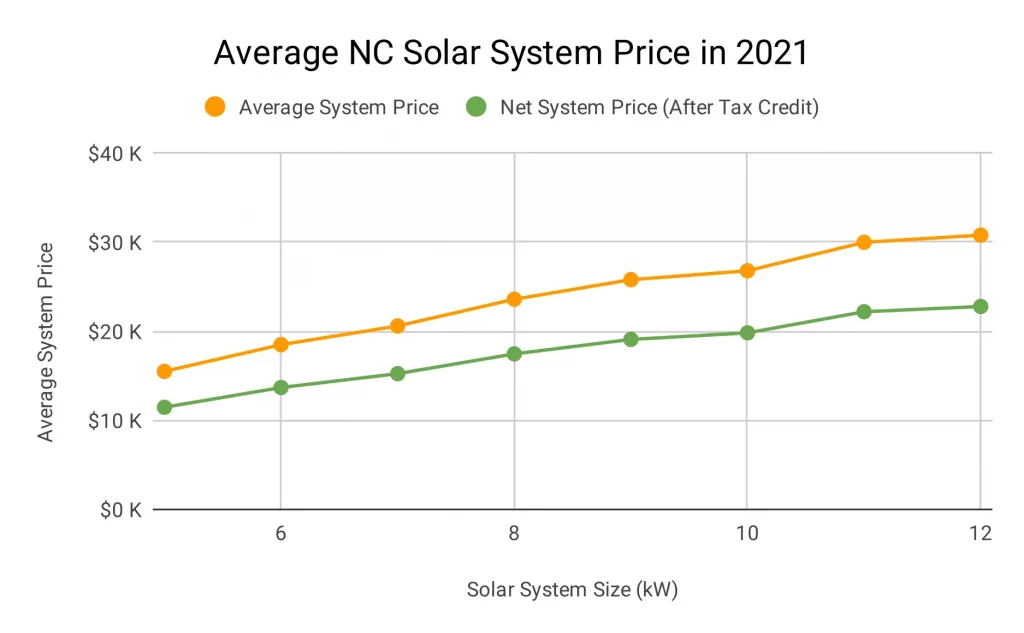

. The effective date for this is after December 31 2021. North Carolina offers a state emissions testing exemption and car pool lane access to electric and alternative fuel vehicles. In this example if you owe 7500 in taxes you will only need to pay 480 after claiming the solar ITC on your solar PV system 7500.

Oregon offer a rebate of 2500 for purchase or lease of new or used Tesla cars. The list below contains summaries of all North Carolina laws and incentives related to electricity. Duke Energy has run out of available funds for rebates in the first half 2022.

This means for an average 27000 solar system the homeowner can claim around a 7020 credit when filing their 2021 taxes. To begin with some feel it sends the wrong message discouraging. Clean Cities Coalitions North Carolina is home to the following.

Green Driver State Incentives in North Carolina. Anyone who purchases a Tesla in any state can get 7500 knocked off their federal tax bill as a credit. Electric Vehicles Solar and Energy Storage.

Some state have income caps or special rules for Teslas in particular due to the higher MSRP of some Tesla modelsand the fact that Teslas are not sold through typical franchise dealerships. State Incentives Alternative Fuel Tax Exemption. Tesla tax credit 2021 north carolina Sunday February 27 2022 Edit.

Top content on Tax Tax Credit and Tesla as selected by the EV Driven community. 35 tax credit on price of an EV up to 1500 for a BEV and 1000 for a PHEV. Opry Mills Breakfast Restaurants.

Tax credits for heavy duty electric vehicles with 25000 in credit available in 2017 20000 in 2018 18000 in 2019 and 15000 in 2020. Tesla to get access to 7000 tax credit on 400000 more electric cars in the US with new incentive reform. Then from October 2019 to March 2020 the credit drops to 1875.

PHEVs exempt from states 03 motor vehicle sales tax. Expired Repealed and Archived Laws and Incentives View a list of expired repealed and archived laws and incentives in North Carolina. Powerwall is designed to qualify for the Federal Tax Credit when it is installed on an existing or new solar system and is charged 100 with solar energy.

The tiles have an ASTM D3161 Class F wind rating and a ANSI FM 4473 Class 3 hail rating. Make the tax credit refundable meaning that someone with a tax liability of only 3500 could get the full benefit of the 7500 credit as they would receive a 4000 tax refund. BEVs exempt from states 65 sales tax.

Solar customers can join a waitlist. Restaurants In Erie County Lawsuit. The following perks include electric car emissions test exemptions high occupancy vehicle HOV lane access federal tax incentives auto insurance discounts and more.

It does not qualify when installed without solar or if solar is installed after Powerwall. The fees presence has created a highly controversial debate leaving the public divided in their opinions. Tesla S 7 500 Tax Credit Goes Poof But Buyers May Benefit Wired Tesla Model S 3 X Y In California Now Eligible For Additional 1 500 Tesla Earns Modest Q2 Profit Delivers 5.

Restaurants In Matthews Nc That Deliver. Local and Utility Incentives. The retail sale use storage and consumption of alternative fuels is exempt from the state retail sales and use tax.

2nd 2021 948 am PT. There are also rebates available for nonresidential customers worth 030Watt up to 30000 and for nonprofit customers worth 075Watt up to 75000. Tesla and GM are set to.

Tax credit up to 50 of cost or 2500 for an EV conversion. Charging station parts and labor costs also exempt from state sales tax. Tesla Tax Credit 2021 North Carolina.

From April 2019 qualifying vehicles are only worth 3750 in tax credits. Tesla Solar Shingle Specs. At least 50 of the qualified vehicles miles must be driven in the state and the credit expires at the end of 2020.

To get a better grasp on how the fee is affecting the North Carolina EV community we reached out to several Plug-in NC ambassadors to hear their positions on the tax. Certainly theres a better way to process rebate claims as thereve been reports of challenges getting these credits from solar installers. A refundable tax credit is not a point of purchase rebate.

An average 8 kilowatt kW system would be eligible for a rebate of 3200. You should always consult your tax professional for your situation. Points of Contact Get contact information for Clean Cities coalitions or agencies that can help you with clean transportation laws incentives and funding opportunities in North Carolina.

Regardless if you go solar in 2021 you can work with your installer to claim the 6000 in early 2022. Majestic Life Church Service Times. If you purchased a new EV in May of 2021 you would apply for the tax credit when you file your 2021 taxes at the beginning of 2022.

Thats all fancy jargon to say the tiles are tested to hold up to 110mph winds and 1 ¾ inch hail. You can get a tax credit of 25 for any alternative fuel infrastructure project including building an electric. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer.

After that the credit phases out completely. Tesla is seeing a delay in its lithium supply for next year as a North Carolina mining. Nissan is expected to be the third manufacturer to hit the limit but.

11th 2021 622 am PT. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. North Carolinas green-minded drivers can save time and money through numerous eco-friendly driving incentives.

Discounted charging rate. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. What about Tesla.

Teslas solar shingles are a sleek slate grey at 15x45 and come with a 25 year tile power and weatherization warranty. There are also many state-specific tax credits rebates and other incentives.

Elon Musk S Us Tax Bill 11 Billion Tesla S 0

Why You Can T Buy A Tesla In Some States

Electric Car Tax Credits What S Available Energysage

Tesla S Fremont Car Plant Was Most Productive In North America In 2021 Report Car News

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Residential Solar Tax Incentives Renu Energy Solutions

Apply For A Rebate Clean Vehicle Rebate Project

Which Vehicles Qualify For An Ev Tax Credit In 2022 Getjerry Com

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

As Georgia Recruits Electric Vehicle Maker Rivian The Number Of Evs And Charging Stations Lags

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Nc Solar Incentives To Take Advantage Of In 2022 Southern Energy Management

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek